🧾 Invoices¶

Invoices in Dhanman make billing intelligent and effortless — designed for real users, not accountants.

The system automates product, GST, and approval logic, ensuring compliance with minimal manual work.

📘 Overview¶

An Invoice records the sale of goods or services to a customer.

Dhanman supports the complete lifecycle — from creation, multi-level approval, and payment, to audit and reversal — all traceable and transparent.

💡 Core Principle: No invoice is ever deleted — every action is auditable.

🔁 Invoice Lifecycle¶

flowchart TD

A[Draft] --> B[Pending Approval - Level 1]

B --> C[Pending Approval - Level 2]

C --> D[Approved]

D --> E[Paid]

E --> F[Audited]

D --> G[Reversed / Canceled]

G --> AStage Definitions¶

| Stage | Description |

|---|---|

| Draft | Created but not yet submitted. Fully editable. |

| Pending Approval – Level 1 | First approver reviews invoice. |

| Pending Approval – Level 2 | Second-level approver validation (optional). |

| Approved | Finalized and ready for payment. |

| Paid | Payment recorded manually or via gateway. |

| Audited | Locked after verification; prevents modification. |

| Reversed / Canceled | Invoice canceled before audit — returns to Draft state. |

🧩 Key Highlights¶

| Feature | Description |

|---|---|

| 🧠 Customer-specific Products | Each customer can have pre-linked products or services, automatically prefilled on selection. |

| 💡 Auto GST Intelligence | Each product carries its configured GST rate. The system determines CGST + SGST or IGST automatically based on customer state. |

| 🔁 Recurring Invoices | Schedule weekly, monthly, or yearly billing. Ideal for maintenance or rent. |

| 📋 Copy Existing Invoice | Duplicate from any previous invoice — all details and taxes included. |

| ⚙️ Multi-Level Approvals | Two configurable approval layers (Company or Account level). |

| 📊 Dashboard Insights | View invoices by status, overdue count, and financial year performance. |

| 🧾 Smart Defaults | Account mappings, tax preferences, and numbering handled automatically. |

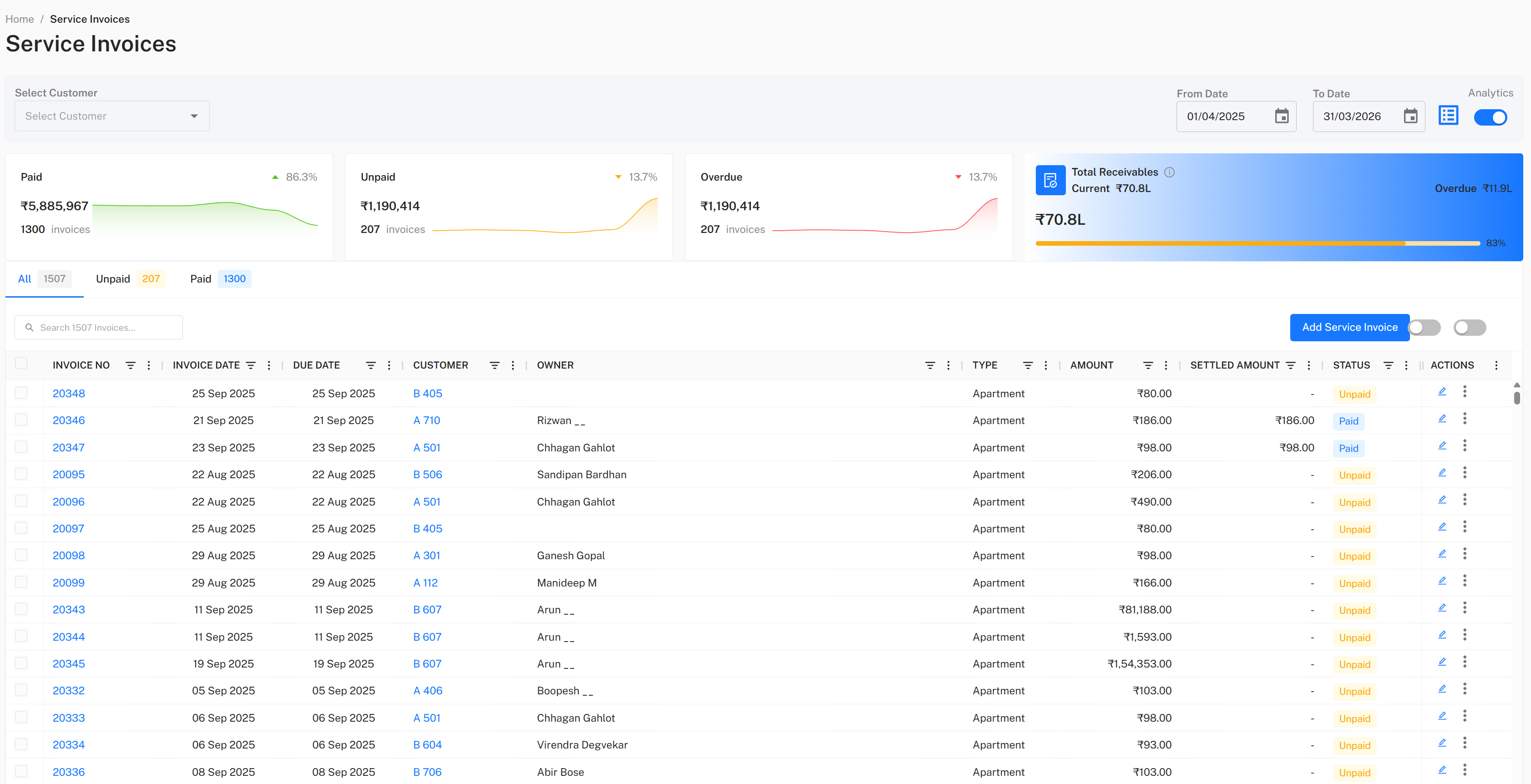

🖥️ Invoice Dashboard¶

The dashboard offers:

- Filters for Draft, Pending, Paid, Audited, and Reversed

- Graphs for total billed, collected, and outstanding

- Trends by month or quarter

- Quick actions for New, Copy, or Import

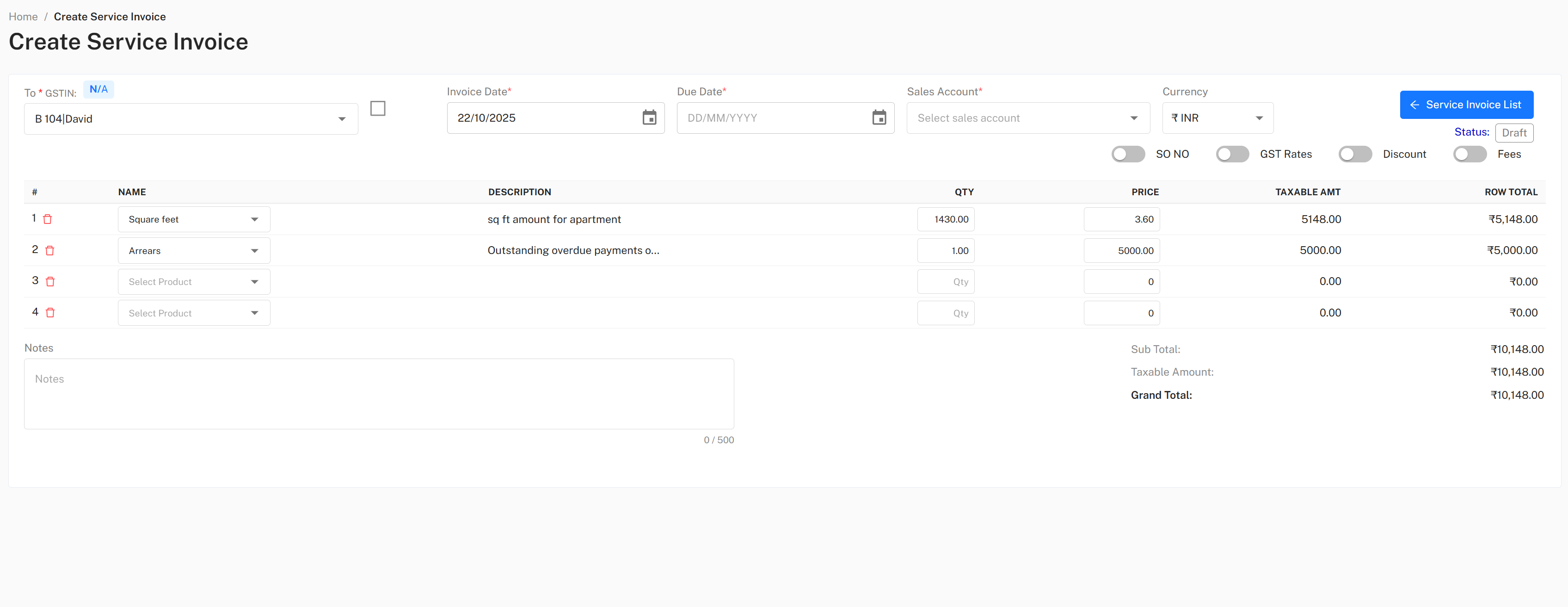

🧾 Creating a New Invoice¶

- Navigate to Income → Invoices

- Click ➕ New Invoice

- Select a Customer → linked products auto-load

- Set Invoice Date, Due Date, and Payment Terms

- Add or adjust Items/Services

- GST rates applied per product

- System picks CGST + SGST (same state) or IGST (inter-state)

- Add optional Discounts, Shipping, or Adjustments

- Add Notes or Terms & Conditions

- Click Save as Draft or Submit for Approval

💡 Tip: Copy from an old invoice to reuse customer, items, and taxes.

🔁 Recurring Invoices¶

flowchart LR

A[Original Invoice] --> B[Recurring Template]

B --> C[Auto-Generated Invoice]

C --> D[Approval → Payment → Audit]Setup Steps¶

- Choose Schedule Recurring from invoice actions

- Set Frequency (Weekly / Monthly / Quarterly / Yearly)

- Define Start Date and optional End Date

- The system generates new invoices automatically using the same items, taxes, and customers

🧠 Approval Workflow¶

| Level | Scope | Typical Role |

|---|---|---|

| Level 1 | Organization | Finance Manager / Admin |

| Level 2 | Account Level | Treasurer / Accountant |

Both approvals are logged permanently for audit trail.

💸 Payments¶

Once approved: - Record manual payments (cash, cheque, transfer) - Capture gateway payments (e.g., UPI, cards) - Apply Advances / Credits - Integrate with Bank Reconciliation

Payment confirmation transitions the invoice to Paid.

Only Audited invoices are fully locked.

🔁 Reversals (Canceling Invoices)¶

- Use Reverse Invoice before audit to cancel incorrect invoices.

- Invoice becomes Reversed / Canceled and reverts to editable Draft.

- No ledger or journal entry is posted until re-approval.

⚠️ Once audited, reversal isn’t allowed. Use before locking.

📦 Importing Invoices¶

To import existing invoices:

- Go to Income → Invoices

- Click More → Import Invoices

- Upload a

.csvor.xlsxfile - Map columns → preview → confirm

- The system validates customers and GST automatically

💡 A sample format is downloadable from the import page.

🧭 Quick Actions¶

| Action | Location | Description |

|---|---|---|

| ➕ New Invoice | Dashboard | Create fresh invoice |

| 📋 Copy | ⋮ Menu | Duplicate existing invoice |

| ⏰ Schedule Recurring | ⋮ Menu | Automate periodic invoices |

| 🔁 Reverse | ⋮ Menu | Cancel and return to Draft |

| 📥 Import | More Menu | Bulk upload invoices |

💡 Best Practices¶

- Define customer-product mappings for repeat clients

- Let GST auto-apply — avoid manual overrides

- Review Pending Approvals weekly

- Use Recurring Invoices for subscriptions or maintenance

- Prefer Reversal instead of deletion for clean audit logs

📚 Related Topics¶

© B2A Technologies Pvt. Ltd. – Dhanman Product Documentation (2025)

Smart. Simple. Transparent.